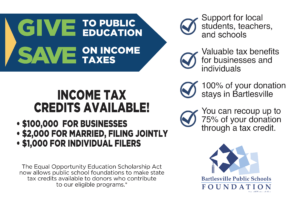

Direct a portion of your state income taxes to benefit Bartlesville Public Schools

The Oklahoma Legislature expanded the Equal Opportunity Scholarship Act to allow taxpayers to receive tax credits for certain donations to public education. By taking advantage of this change you may receive up to 75% of the donation back in the form of a state income tax credit, substantially reducing your Oklahoma state income tax liability. The Bartlesville Public Schools Foundation is the only approved organization within the Bartlesville Public Schools District to offer these tax savings for eligible donations to public education.

-

With a 1 year commitment, you are eligible for a 50% tax credit.

-

With a 2 year commitment, you are eligible for a 75% tax credit.

Limits and Eligibility Requirements

Tax Credit Limits:

The Oklahoma Education Tax Credit program has annual limits on the state income tax credits the OTC will issue.

- $25 million in tax credits may be issued for public education statewide

- $200,000 cap for our Bartlesville Public Schools

- $1,000 cap for an individual / single filing

- $2,000 cap for married filing jointly

- $100,000 cap for businesses

Eligibility Requirements:

- Donations must be a minimum of $1,000 and donors must indicate their interest in taking advantage of these tax credits when the donation is made.

- Donations must be postmarked by December 31

- Donors must complete the tax-credit eligibility form

- Donors must submit their tax receipt with their tax filings

How to Contribute?

- Mail a check to BPSF, payable to the “BPS Foundation” along with the completed Donation Form.

- BPSF will send you a tax receipt for your records. Submit this tax receipt with your tax filings.

Don’t miss the chance to direct funds – funds you would otherwise pay in state income taxes – to support innovative programs within Bartlesville Public Schools!

FAQ’s:

What’s the difference between a tax deduction and tax credit?

- A tax deduction reduces taxable income. A $1,000 tax deduction in a 35% tax bracket saves you $350 in taxes.

- A tax credit reduces income taxes. A $1,000 tax credit in ANY tax bracket saves you $1,000 in taxes.

How will this impact my federal income taxes?

- If you itemize your tax deductions, the federal charitable deduction must be reduced by the amount of state tax credit received.

- Under the Safe Harbor federal deduction option, some people will be able to reduce their taxable income even further.

What amount should I contribute in order to max out my personal credit cap (assuming I’m making a 2 year gift commitment and receiving the 75% credit?

- Individual: $1,334 per year (A 75% credit will result in a $1,000 credit per year, with a net cost to the donor of $334 to make the gift).

- Joint: $2,667 per year (A 75% credit will result in a $2,000 credit per year, with a net cost to the donor of $667 to make the gift).

- Business: $133,334 per year (A 75% credit will result in a $100,000 credit per year, with a net cost to the donor of $33,334 to make the gift).

I know the amount I want to get back in tax credits. How do I determine the amount I should donate to get a specific credit amount back?

Check out this handy Tax Credit Table where you can “pick your credit” and determine your suggested donation amount.

What happens if the statewide or district cap is met?

If the statewide or District cap is met, the Oklahoma Tax Commission plans to prorate taxpayer’s credit and the taxpayer will be permitted to use any unclaimed credit in the following year. If the tax credit cap is met, you will receive a letter from BPSF by mid-February following the year in which you made the gift, letting you know what percentage of your credit you are able to claim on that year’s taxes.

Can I see an example?

Without the advantage of the tax credit:

Donation to BPSF…..$1,000

Tax Credit:………………….$0

Annual cost to taxpayer……$1,000

Utilizing the 1 year commitment and 50% tax credit:

Donation to BPSF…..$1,000

Tax Credit:……………………$500

Annual cost to taxpayer…….$500

Utilizing the 2 year commitment and 75% tax credit:

Donation to our schools…..$1,000

Tax Credit:……………………$750

Annual cost to taxpayer…….$250

What did the Foundation spend these funds on last year?

Innovative programs funded with the tax-credit eligible donations this past year.

The information provided by the BPS Foundation is not intended to constitute tax or legal advice. All content herein is for informational purposes only. BPSF recommends you consult with your tax professional or financial advisor for tax advice based on your specific financial circumstances.